Margin trading attracts many traders because of the possibility of boosting returns with borrowed funds.

However, frequent use of margin can expose you to bigger risks if you are not careful. It is easy to overlook important details when you trade on margin regularly.

That is why it helps to build strong habits and stay prepared at every step.

In this article, we will explain the key things you should always have in place if you use margins often.

Key Essentials for Frequent Margin Users

Anyone who trades with margin regularly must approach the market with discipline and careful preparation. Below are the most important things you should have in place before you increase your exposure through leverage.

1. Solid Risk Management Plan

Having a well-defined risk management plan is essential for anyone trading with margin. Before entering any position, decide the exact amount you are comfortable risking.

Use stop-loss orders to set automatic exit points and resist the temptation to increase your exposure if a trade is not working out. Stick to your own guidelines even if an opportunity looks attractive.

With a clear plan and consistent discipline, you can limit losses and give yourself a better chance of succeeding over the long run.

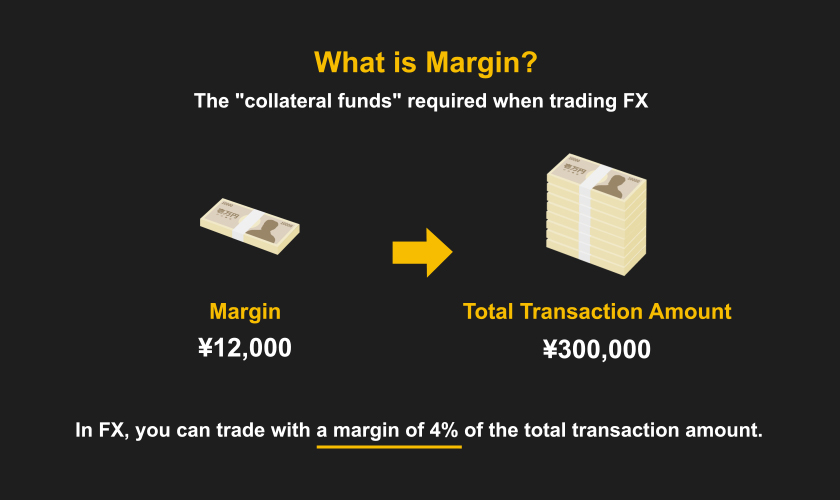

2. Clear Understanding of Margin Requirements

A clear understanding of margin requirements is crucial for anyone using a margin facility. You need to know the difference between initial and maintenance margin, as these determine how much capital you must deposit and retain to keep positions open.

If your equity drops below the maintenance level, you might face a margin call, requiring additional funds to avoid forced liquidation.

It is important to check your broker’s rules and keep track of your account balances before using any margin trading facility, so you can manage risk effectively.

3. Emergency Fund or Buffer Capital

Building up an emergency fund or buffer capital is one habit every margin trader should prioritize. If you keep extra money aside in your trading account, it is easier to handle sudden margin calls or market dips.

This financial reserve protects you from having to sell your investments at a loss just to cover shortfalls. More importantly, it gives you space to think clearly and act calmly, even during market stress.

Being prepared with a buffer helps you stay in control, not rushed into decisions.

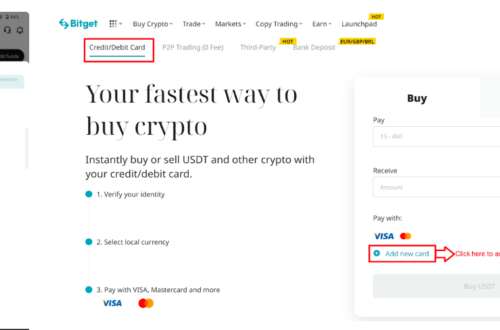

4. Reliable Trading Platform and Tools

Finding the right trading platform is a step that should never be rushed. The best trading platform gives you fast price updates and flexible alerts, which are especially helpful when you are trading with margin.

Look for features that show your margin requirements clearly and support your risk management plan. Having solid customer support and dependable security gives you extra peace of mind.

Take time to test different platforms so you feel comfortable and confident before starting any margin trades.

5. Up-to-Date Market Knowledge

Keeping up with market trends is essential for anyone trading on margin. Make it a habit to follow economic reports, company news, and global financial developments every day.

A sudden market move can have an immediate impact, especially when leverage is involved. Review analyst commentary, and try to discuss your views with other investors if possible.

By investing time in ongoing research, you give yourself an edge. Staying alert to market shifts allows you to manage risk and make better decisions for your portfolio.

Conclusion

Careful use of margin calls for steady discipline and strong risk management. Always check your positions and keep extra funds available, since financial markets can shift without warning. By combining market awareness with clear planning, margin users give themselves a better chance to navigate trading challenges and avoid costly surprises that can harm long-term results.